Companies incur a wide range of fees and expenditures while operating their enterprises. These expenses may be one-time or ongoing, and keeping track of them all may be challenging. How, therefore, do they manage to maintain tabs on everyone?

CapEx vs. OpEx – Which Option is Preferred by Businesses?

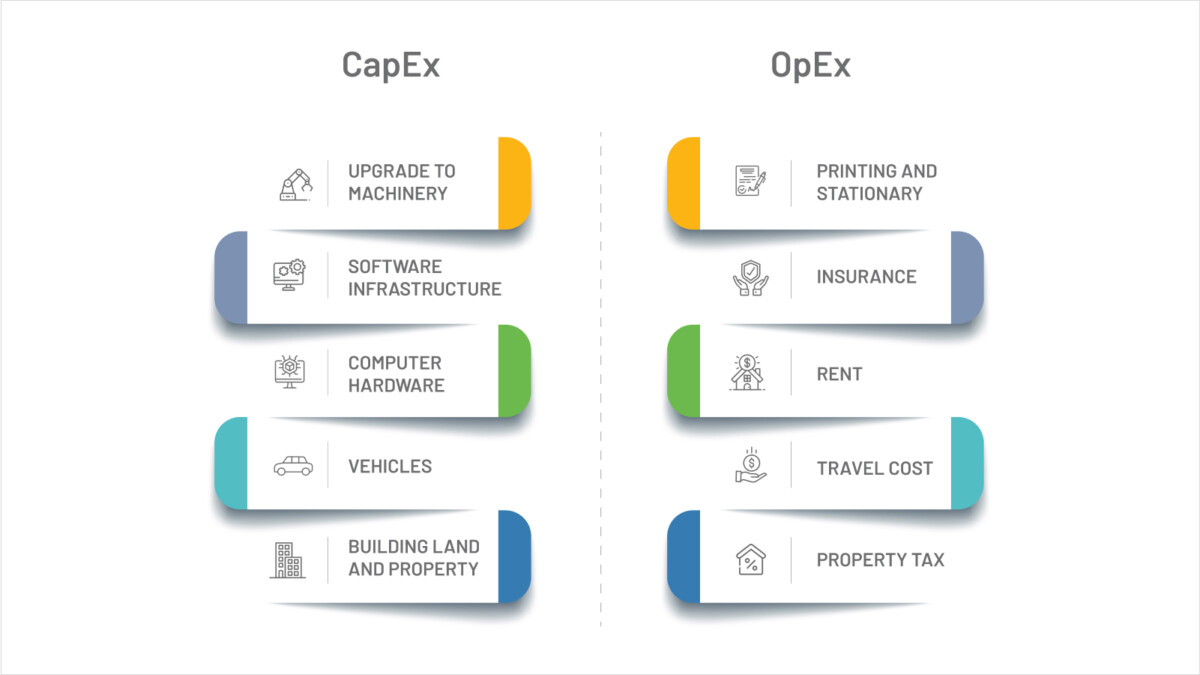

Capital expenditures (CapEx) and operational expenditures (OpEx) are typical ways to classify business costs. In business, capital expenditures refer to significant acquisitions made for long-term usage. Conversely, operating expenditures are the regular cash outlays necessary to keep a firm afloat. From a fiscal perspective, it is imperative to acknowledge that Capital Expenditures (CapEx) and Operational Expenditures (OpEx) hold distinct significance. Businesses, driven by diverse rationales, exhibit a preference towards either of these categories.

The primary distinction between these two expenses resides in the accounting approach accorded to each. In the context of business operations in the United States, it is commonly observed that the accepted accounting rules (GAAP) play a significant role in determining the appropriate treatment of expenditures on a company’s financial statements. Hence, a firm needs to comprehend the enduring financial consequences of the impact on its reporting and external stakeholders’ subsequent perception of the company’s financial well-being.

Capex- Explained

Capital expenditures, commonly called CapEx, encompass acquiring substantial goods or services to enhance a company’s future performance. The expenses include fixed assets and the procurement of intangible assets, such as patents and various technological assets. Capital expenditures refer to investments made in fixed assets such as property, plant, and equipment (PP&E).

To illustrate, when an oil company acquires a new drilling rig, the corresponding transaction would be classified as a capital expenditure.

One of the distinguishing characteristics of capital expenditures is their longevity, indicating that these acquisitions provide long-term benefits to the company beyond a single tax year.

CapEx can be identified based on the following distinguishing characteristics:

- Purchases represent singular upfront payments.

- The business must exclusively hold the ownership of the asset after the acquisition.

- The acquired asset must provide a business with benefits that extend beyond a single tax year.

CapEx is further explained into two categories. These are:

- Maintenance CapEx: Buying new assets to maintain, renew, or replace current ones.

- Expansion CapEx: These are company asset expansion or performance enhancement costs. These aim to grow businesses.

Information on Capital Expenditures may be found in the cash flow statement, as well as the income statement and balance sheet.

OpEx- Explained

Operating expenses, commonly referred to as OpEx, are the costs incurred by a company to maintain its day-to-day operations. These expenses are essential for the functioning of the business.

Operating or operational expenditures encompass an organization’s financial outlay to facilitate and sustain its business activities.

OpEx, short for operating expenses, is a crucial component that companies disclose on their income statements. These expenses encompass the day-to-day costs incurred by a business to maintain its operations. It is worth noting that companies can deduct these OpEx from their taxable income, thereby reducing their tax liability for the fiscal year in which the expenses were initially accrued.

Operational Expenditure (OpEx) can be further classified into the subsequent categories:

- Fixed expenses remain constant and cannot be avoided, consisting of several essential costs, such as personnel remuneration, accounting, legal fees, and office supplies, among other expenditures.

- Variable costs are those that change with the amount of business firm conduct. When a corporation increases its production, there is a corresponding increase in expenditures, and conversely, when production decreases, expenses decrease as well. Alterations can influence variable expenditures in the economy or organizational structure.

Operational costs play a crucial role in the comprehensive assessment of a company’s financial outlays, identifying potential areas for cost reduction, and optimizing the efficiency of stock management practices. These metrics primarily revolve around the cost structure necessary to generate revenue, which is the fundamental goal of any business.

Failure to effectively manage operating expenses may result in financial losses due to oversights in spending. To sustain long-term profitability, it is imperative to promptly acknowledge and account for operational costs, ensuring a consistent growth trajectory for the company’s bottom line.

CapEx vs. OpEx

When it comes to comparing spreadsheets and custom-built, web-based applications, rest assured that there are several significant differences that you should be excited to learn about in terms of how they efficiently handle and maximize the value of your data. These encompass various elements such as:

| CapEx | OpEx |

|---|---|

| Capital expenditures refer to the cash or expenses necessary for acquiring fixed assets, which must be utilized during the same fiscal year of their purchase. | These expenses are essential for the optimal operation of a firm daily. |

| The expenditure in question is of prolonged duration. | The expenditure in question is temporary. |

| Categorized as an expenditure related to property or equipment. | Indicated as expenditures to create income, such as activities, support, maintenance, and operation. |

| The deduction of this expense from taxable income is not permissible. | It is possible to claim tax deductions. |

| The presence of a capitalized asset can be observed in the company's cash flow statement. | The expenditure in question is readily observable in a firm's income statement and is promptly recognized as an expense |

| The procurement process is subject to a multi-tiered approval structure, resulting in notable time lags. | The approval process is expedited if the proposed purchase is within the allocated budget. |

| All expenditures are fully covered mostly in a single transaction, yet realizing profits requires significant time. | Expenditures occur periodically, either on a monthly or yearly basis. |

| This includes the acquisition of equipment and machinery, as well as the procurement of intellectual property or innovation assets, such as patents. | This includes operational expenses such as equipment maintenance and repair, energy supply costs, rental fees, and employee compensation. |

Which Option is Preferred by the Majority of Businesses?

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) are two interconnected financial aspects that cannot be objectively compared in terms of superiority. Both categories, namely cost classification methods, serve as essential components for a business’s expansion.

Businesses are advised to consider investing in capital expenditures (CapEx) to pursue future expansion and secure enduring financial resources. However, it is possible to opt for operational expenditures (OpEx) when the business aims to preserve its capital and maintain a certain level of flexibility.

When should one opt for capital expenditures (CapEx)?

CapEx assumes a significant role in several domains, including but not limited to:

Capital expenditures (CapEx) can facilitate a company’s expansion and achieving objectives, provided all relevant factors are considered when formulating a comprehensive capital expenditure strategy.

- Businesses that make early technological investments may qualify for tax breaks through their choice of capital expenditures (CapEx), which may vary from nation to nation.

- Business enterprises can potentially secure advantageous tax benefits by opting for capital expenditures (CapEx). This strategic financial decision may vary across different countries, mainly when investing in technology during the initial phases.

When should one opt for operating expenses (OpEx)?

The OpEx initiative is strategically developed to attain optimal levels of corporate performance. In the aftermath of the Covid period, the foremost concern for a corporation is centered on the pursuit of cost reduction. Considering those above, it is evident that Operational Excellence (OpEx) might provide advantageous outcomes for a corporation due to the subsequent rationales:

- Adopting an Operational Expenditure (OpEx) model will allow the firm to allocate its existing finances towards additional operations that generate income, such as lead generation, research and development, and resource expansion.

- When a business adopts cloud-hosted services, it could achieve cost savings in recruiting IT (Information Technology) resources since the responsibility for maintaining the hosted services lies with the suppliers.

- Several organizations choose for OpEx due to its tax advantages since it allows them to deduct the expenses associated with hosting services fully.

Capital Expenditure (CapEx) vs. Operational Expenditure (OpEx): Determining the Optimal Choice for Your Organization

Fortunately, the decision between CapEx and OpEx is not a binary choice.

Organizations must make informed decisions on categorizing various expenditures as capital expenditures (CapEx) or operational expenditures (OpEx) while comprehending the associated trade-offs. Specific corporate systems may need full ownership and internal management, but other applications might be more flexible and adaptable to changing needs and personnel.

- Effective forecasting enables companies to make informed investment decisions in capital expenditures (CapEx) and correctly estimate operational expenditures (OpEx).

- It is also advised by experts to consider the non-monetary implications of the transaction. This can include people’s difficulty moving from one type of technology to another, which is common in a CapEx/OpEx trade-off.

Irrespective of the chosen expenditure model, the presence of visibility and control over one’s infrastructure, whether in a Capital Expenditure (CapEx) model located on-premises or an Operational Expenditure (OpEx) model in public or private clouds, empowers individuals to make decisions that will have a significant influence on the overall performance of their firm.

Takeaways: Consider the importance of selecting an exceptional time and expense tracking tool. Managing expense reporting can be daunting, but with the right tool, you can streamline the process and save valuable time. Look for a tool that offers configurable policies for time and expenses, allowing you to customize it to fit your needs. By making this wise choice, you can effortlessly handle expense reporting and ensure accuracy and efficiency in your financial management.

Imagine having a tool that provides you with real-time analytics and seamlessly integrates with your project management, ERP, and accounting tools. This powerful combination allows you to streamline your processes, make informed decisions, and meet all necessary compliances effortlessly. Say goodbye to manual data entry and hello to a more efficient and compliant workflow. Choose AccountSight, which empowers you to work smarter, not harder, and efficiently manage all expenses, be it Capex or Opex, at the click of the mouse.